Credit Analysis & Research (CARE), has downgraded rating of Ranbaxy Laboratories' long term debt instruments to 'AA' from 'AA+'.

Credit Analysis & Research (CARE), has downgraded rating of Ranbaxy Laboratories' long term debt instruments to 'AA' from 'AA+'.

Long term Instruments with CARE AA rating are considered to have high degree of safety regarding timely payment of financial obligations and carry very low credit risk.

However, CARE has reaffirmed the 'A1+' rating assigned to the short term bank facilities of the company. Short term debt instruments with CARE rating of A1+ are considered to have very strong degree of safety regarding timely payment of financial obligations and carry lowest credit risk.

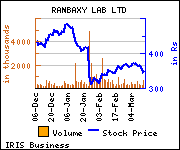

Shares of the company declined Rs 11.3, or 3.18%, to settle at Rs 343.65. The total volume of shares traded was 718,520 at the BSE (Friday).